When investing, apart from style i.e. your sectoral expertise or preferences as the case may be the most important fact that will ultimately determine your success as an investor is your strategy. By strategy I mean a well planned or established pattern of trading securities which combines natural instincts with lessons learned. Lessons learned is ultimately what makes the difference: the difference between a good investor and an okay one is that the former keeps the lessons of his error to heart while the later just keeps getting by.

In the past 6-9 months I have stuck to a single strategy in my mock portfolio: which can be basically summarized as follows (and you could have caught it in the description if you checked earlier)

1. Hold between 25-30 stocks in leading sectors

2. Allocate not more than 5% in one stock; cut stocks that rise above this level

3. Invest in best of breed of every sector

4. Include a mix of gon-go penny stock to juice up portfolio

5. Minimize trading costs and commission hence buy in blocks of 3 on the downside

6. Do not anticipate sectoral rotation i.e. let your winners roll

7. Patience, Patience, Patience

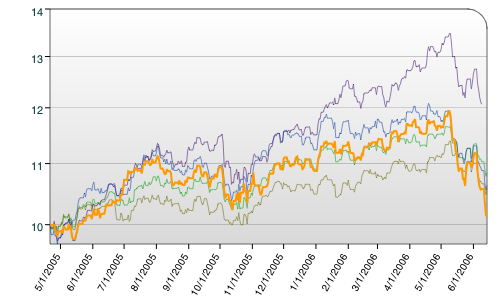

This strategy has paid of handsomely; sending me 20% up in 9 months. But alas it came all crashing and here is why. Let me examine lessons learned.

1. The strenght of this strategy obviously is that aggregate risk is optimal while there is a reasonable more than average upside to the portfolio. Reduced trading also reduces overall fees.

2. The weakness of course is its very strenght. Due to lack of trading you pay less attention to daily trends hence you can end up in the hole if the market moves downwards or sideways against you as it has done in the past 30 days. While patience and allowing your winner roll is an okay strategy you can get clobbered badly if market sentiments are firmly against your positions. The lack of concentration in definite bulls also makes it harder to pull up when you crash down badly. (30 stocks are too many to follow up on part time basis).

In the last 30 days, all but 3% of the gains of the past 9 months have been wiped out. I did allow this to happen intentionally to illustrate what the downside of this strategy. However, I am trying something new as I always do. From now till the end of the year, I have a new strategy. Go with me:

1. Invest in 15-20 best of breed stocks

2. Allocate not more than 10% to a stock; however don't cut any freewiller if they rise

3. Use specific securities to invest in a sector that is favor

4. Use the advantage of fewer stocks to rotate out of out of favor sectors

5. Trading rules are liberalized but are anticipated to continue to be on the low side

6. Own 3-5 forward looking stocks and invest big in them. Stake your claim.

7. Research, Research, Research

I don't know where I will be in December when we do a spot review; neither do I know if the Feds would have clobbered the economy. All I know is that next April I will remember that cash is king and that May, August and September are the market's worst month. I hope you took some metals off the table the last time. I however think that they were oversold now is the time to jump in. BHP, TRE and MEE are still my best picks. I shall explain in the next posting.

Till then: keep on keeping on.